Introduction

The world of international trade can be as thrilling as a rollercoaster ride, especially when it comes to understanding custom duty from China to India. Custom duties are essentially taxes imposed on goods imported into a country, and they play a significant role in shaping the trade landscape. With the right knowledge and tools, businesses can navigate these waters smoothly and even find ways to optimize their costs.

Understanding Custom Duty Concepts

At its core, custom duty from China to India is designed to regulate the flow of goods across borders while generating revenue for governments. This tax varies based on product type, value, and origin, making it essential for importers to grasp these concepts thoroughly. Without this understanding, businesses may face unexpected costs that could derail their profit margins.

Importance of Customs Regulations

Customs regulations are not just bureaucratic red tape; they ensure that trade is conducted fairly and safely. For companies like SSOURCING INC., adhering to these regulations is crucial in avoiding penalties and ensuring smooth operations when importing goods from China. Ignoring customs laws can lead to delays, fines, or even confiscation of goods—definitely not an ideal scenario!

Overview of Duty Structures

Navigating the duty structures associated with custom duty from China to India involves knowing various factors like product classifications and applicable rates. These structures dictate how much you’ll pay when bringing products into India and can vary widely between different categories of goods. By familiarizing yourself with these intricacies early on, you’ll be better equipped to manage your import expenses effectively while maximizing your business's potential.

What is Custom Duty?

Custom duty is a crucial aspect of international trade that plays a significant role in regulating the flow of goods across borders. When importing products, particularly custom duty from China to India, businesses must navigate a complex landscape of regulations and fees. Understanding these duties not only ensures compliance but also helps in budgeting for total import costs.

Definition and Purpose

Custom duty refers to the tax imposed by a government on goods imported into or exported out of a country. Its primary purpose is to generate revenue for the government while also protecting domestic industries from foreign competition. By imposing these duties, countries can regulate trade policies and promote local manufacturing, making it essential for businesses like SSOURCING INC. to grasp its implications when planning imports.

Types of Custom Duties

There are several types of custom duties that businesses should be aware of when importing goods, especially custom duty from China to India. The most common types include ad valorem duties, which are based on the value of the goods; specific duties, which are fixed fees per unit; and compound duties that incorporate both methods. Each type serves different purposes and can significantly affect the overall cost structure for importers.

How Custom Duty Affects Trading

Custom duty has a direct impact on trading dynamics between countries like China and India by influencing pricing strategies and profit margins. For instance, higher custom duty from China to India can lead to increased retail prices for consumers, potentially reducing demand for imported products. Businesses like SSOURCING INC., therefore, need to factor these costs into their pricing models while also exploring ways to mitigate expenses through strategic sourcing and compliance with regulations.

The Process of Importing Goods

Importing goods from China can seem like navigating a labyrinth, but with the right steps, it becomes a straightforward journey. Understanding the intricacies of customs regulations and procedures is essential for anyone looking to import products efficiently. In this section, we will break down the process into manageable parts, ensuring you’re well-equipped to handle custom duty from China to India.

Steps to Import from China

The first step in importing goods from China is identifying your supplier and negotiating terms that work in your favor. Once you’ve secured your products, it's crucial to place an order and confirm payment methods, which often include letters of credit or wire transfers. After that, arranging for shipping is vital; whether you choose air freight or sea freight will significantly influence the custom duty from China to India due to differing costs and transit times.

Next comes tracking your shipment until it reaches Indian shores. Upon arrival, you’ll need to prepare for customs clearance by organizing necessary documents and ensuring compliance with regulations. It’s wise to consult with logistics experts or partners like SSOURCING INC., who can guide you through this intricate process while helping you avoid common pitfalls associated with custom duties.

Required Documentation for Customs

When importing goods into India, specific documentation is non-negotiable; without these papers, your shipment could face delays or even fines due to non-compliance with customs regulations. Essential documents include the commercial invoice detailing transaction specifics, packing list outlining how items are packed, and bill of lading as proof of shipment ownership. Furthermore, depending on the nature of your products, additional licenses like import permits may be required.

Ensuring all documentation is accurate not only expedites customs clearance but also minimizes potential issues related to custom duty from China to India. It’s recommended that importers keep copies of all records for their own reference and future audits by authorities. Partnering with SSOURCING INC. can simplify this documentation process as they provide templates and guidance tailored specifically for imports.

Role of SSOURCING INC. in Import Procedures

SSOURCING INC. plays a pivotal role in streamlining the import process by offering comprehensive support at every stage—from sourcing products in China to managing customs compliance in India. Their expertise helps navigate complex regulations surrounding custom duty from China to India effectively while ensuring that all paperwork is correctly completed and submitted on time.

Moreover, SSOURCING INC.'s team stays updated on any changes in trade agreements or duty rates that could impact your bottom line significantly—making them an invaluable partner in maximizing cost savings during imports. By leveraging their resources and knowledge base, businesses can focus more on growth rather than getting bogged down by bureaucratic hurdles associated with international trade.

Calculating Custom Duty from China to India

Understanding how to calculate custom duty from China to India is essential for any importer looking to navigate the complexities of international trade. The calculation involves several factors, including the product type, value, and applicable tariffs. With the right knowledge and tools, you can ensure compliance and avoid unexpected costs.

Factors Influencing Duty Calculations

Several key factors influence the calculation of custom duty from China to India. First, the classification of goods under the Harmonized System (HS) code plays a vital role in determining applicable duty rates. Additionally, the declared value of goods significantly impacts how much you’ll owe; undervaluing shipments can lead to penalties while overvaluing them may result in paying more than necessary.

Another important consideration is any additional taxes or fees that may apply beyond standard customs duties. For instance, Goods and Services Tax (GST) might be imposed on imports, which adds another layer of cost that importers must account for when calculating overall expenses. Lastly, fluctuations in currency exchange rates can also affect your final calculations—keeping an eye on these rates can save you some serious cash.

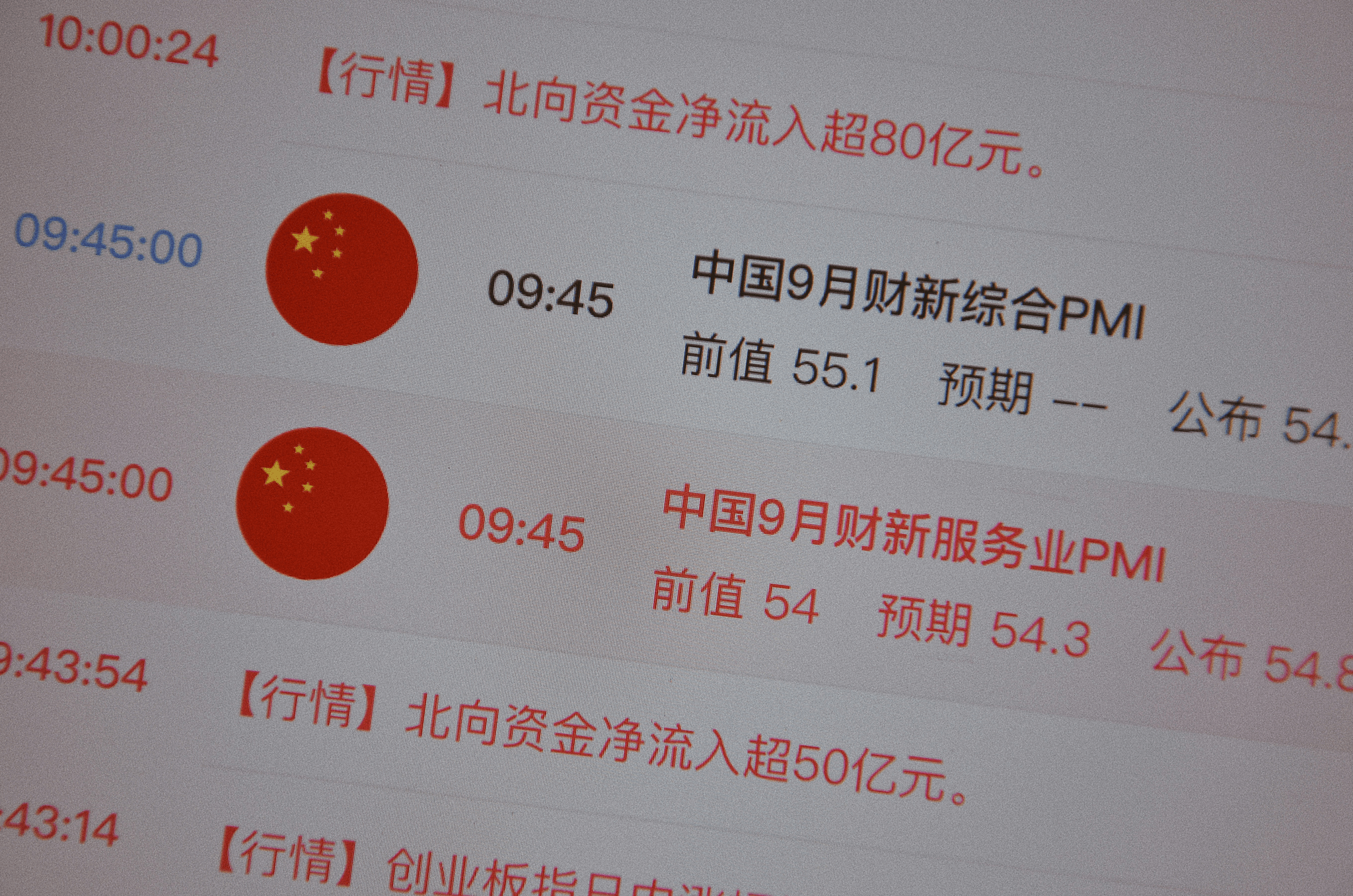

Common Duty Rates for Various Products

When importing goods from China to India, it's crucial to know common duty rates for various products as they vary widely depending on item classification. For example, electronics often carry higher tariffs due to protective measures aimed at local industries—duty rates can range anywhere from 0% up to 30%. On the other hand, textiles typically have lower duties but still require careful classification based on material and use.

Certain products may also benefit from preferential treatment under trade agreements between countries; therefore, it’s wise to stay informed about any changes in these agreements that could affect custom duty from China to India. SSOURCING INC. provides resources that help importers identify these rates quickly and accurately so they can plan their budgets effectively without nasty surprises down the line.

Tools and Resources for Accurate Calculations

To simplify your calculations of custom duty from China to India, numerous tools and resources are available online that cater specifically to importers' needs. Websites like CBEC-GST provide updated information on tariff codes and corresponding duties which are invaluable when planning shipments. Additionally, using duty calculators available through various trade websites allows you to input specific details about your shipment and receive instant estimates.

Moreover, consulting with logistics providers or customs brokers offers personalized guidance tailored specifically for your business needs; they often have access to proprietary databases that track changes in regulations or duty structures over time—ensuring you're always compliant with current laws. SSOURCING INC.'s expert team is dedicated to helping you navigate these tools so you can focus more on growing your business rather than getting bogged down by red tape.

Customs Clearance Procedures

Navigating the labyrinth of customs clearance can feel like a daunting task, especially when dealing with custom duty from China to India. However, understanding the ins and outs of this process can make all the difference between a smooth import experience and a costly delay. With SSOURCING INC. by your side, you can tackle customs clearance with confidence and ease.

Understanding Customs Inspections

Customs inspections are a critical part of the import process that ensure compliance with regulations and proper assessment of custom duty from China to India. These inspections can vary in intensity; some shipments may be randomly selected for thorough examination while others may pass through without any scrutiny at all. Knowing what to expect during these inspections can help you prepare adequately and avoid unexpected hiccups in your shipment's journey.

During an inspection, customs officials will check documentation, assess product classifications, and verify that declared values align with actual contents. It's essential to have all necessary paperwork organized and readily available to facilitate this process. Remember, any discrepancies could lead to delays or additional penalties—so keep everything above board!

Tips for Smooth Clearance

To ensure your goods clear customs without unnecessary delays or complications related to custom duty from China to India, consider these practical tips: first, double-check that all documentation is complete and accurate before shipment arrives at the port of entry. This includes invoices, packing lists, bills of lading, and any required certificates specific to your products.

Second, maintain open communication with your freight forwarder or customs broker; they are invaluable resources who can help navigate complex regulations effectively. Lastly, familiarize yourself with potential red flags that might trigger additional scrutiny—such as unusual shipping patterns or misdeclared product types—to minimize risks.

SSOURCING INC. also recommends staying updated on changing trade policies or tariffs which could impact your import strategy significantly. Being proactive about compliance not only streamlines the clearance process but also shields you from hefty fines down the line.

Importance of Compliance and Penalties

Compliance with customs regulations is not just a bureaucratic requirement; it's vital for maintaining smooth operations when importing goods subject to custom duty from China to India. Failure to adhere strictly to these rules can result in severe penalties including fines or even seizure of shipments—outcomes no business wants on its ledger!

Moreover, consistent compliance builds trust with customs authorities which may lead to quicker processing times in future imports—a win-win situation! By prioritizing adherence today through diligent preparation and ethical practices tomorrow's imports will be much smoother sailing.

In conclusion, understanding customs clearance procedures is crucial for anyone looking to import goods efficiently while managing their obligations regarding custom duty from China to India effectively. With SSOURCING INC.'s expertise guiding you through each step—from inspections through compliance—you'll find that navigating these waters isn't just manageable; it’s downright rewarding!

Navigating Trade Agreements

In the world of international trade, understanding trade agreements is crucial for businesses looking to minimize costs and streamline operations. For companies importing goods, particularly custom duty from China to India, these agreements can significantly impact overall expenses and logistics. SSOURCING INC. recognizes the importance of staying informed about these agreements to better serve our clients.

Key Agreements Between India and China

India and China have engaged in various trade agreements aimed at enhancing economic cooperation and reducing barriers to trade. One notable agreement is the Asia-Pacific Trade Agreement (APTA), which provides preferential tariff rates on numerous products exchanged between member countries, including India and China. Such agreements are pivotal for businesses that want to navigate the complexities of custom duty from China to India while capitalizing on reduced tariffs.

Additionally, regional partnerships like the Regional Comprehensive Economic Partnership (RCEP) may also influence future trade dynamics between these two nations. By being aware of these key agreements, businesses can make informed decisions that optimize their import strategies. SSOURCING INC. actively monitors changes in such agreements to ensure our clients benefit from any potential cost savings.

Impact on Custom Duty from China to India

The impact of trade agreements on custom duty from China to India can be significant, often resulting in lower import costs for various products. These reductions can help businesses maintain competitive pricing in their respective markets while improving profit margins. Furthermore, understanding how specific goods are classified under these agreements allows importers to take full advantage of preferential rates.

For instance, certain electronics or textiles may qualify for reduced duties under current trade arrangements, leading to substantial savings for importers like those working with SSOURCING INC. Moreover, knowing how these duties fluctuate based on evolving policies helps businesses strategize their purchasing timelines effectively—ensuring they import at the right time for maximum benefit.

Leveraging Trade Agreements for Cost Savings

To truly capitalize on the benefits offered by trade agreements, companies must adopt a proactive approach when planning their imports—especially regarding custom duty from China to India. This involves closely monitoring updates related to tariffs and regulations while ensuring compliance with all necessary documentation requirements outlined in these agreements.

SSOURCING INC., with its extensive experience in international sourcing and customs procedures, assists clients by providing tailored advice that aligns with current trade policies—helping them navigate complex landscapes effortlessly while maximizing cost efficiency. By leveraging available resources such as government publications or industry reports, businesses can stay ahead of potential changes that could affect their bottom line.

In conclusion, understanding how key trade agreements influence custom duty from China to India is essential for any business looking to thrive in today’s global marketplace. With careful planning and strategic partnerships like those offered by SSOURCING INC., companies can successfully leverage these opportunities for significant cost savings.

Conclusion

Navigating the world of custom duty from China to India can feel like a maze, but understanding the essentials can save you time and money. From grasping the various types of duties to knowing how they impact your trading activities, having a solid foundation is crucial for any importer. As we’ve explored, the process involves careful planning and compliance with regulations to ensure smooth sailing through customs.

Summary of Custom Duty Essentials

Custom duty from China to India is not just a tax; it's a vital part of international trade that can significantly affect your bottom line. Understanding its definition, purpose, and types helps importers make informed decisions that align with their business strategies. By recognizing how these duties influence trading practices, businesses can better navigate their import processes and avoid unexpected costs.

Best Practices for Smooth Imports

To ensure smooth imports when dealing with custom duty from China to India, preparation is key. Always keep your documentation in order and familiarize yourself with required forms before shipping anything across borders. Additionally, leveraging resources like SSOURCING INC.’s expertise can help you stay compliant while maximizing efficiency in your importing endeavors.

Resources for Ongoing Compliance

Staying updated on customs regulations is essential for anyone involved in importing goods; this includes understanding custom duty from China to India specifically. Utilize online tools and resources provided by government agencies or trusted partners like SSOURCING INC., which offer insights into current rates and compliance requirements. By incorporating these resources into your operations, you’ll not only streamline your import processes but also safeguard against potential penalties.