Introduction

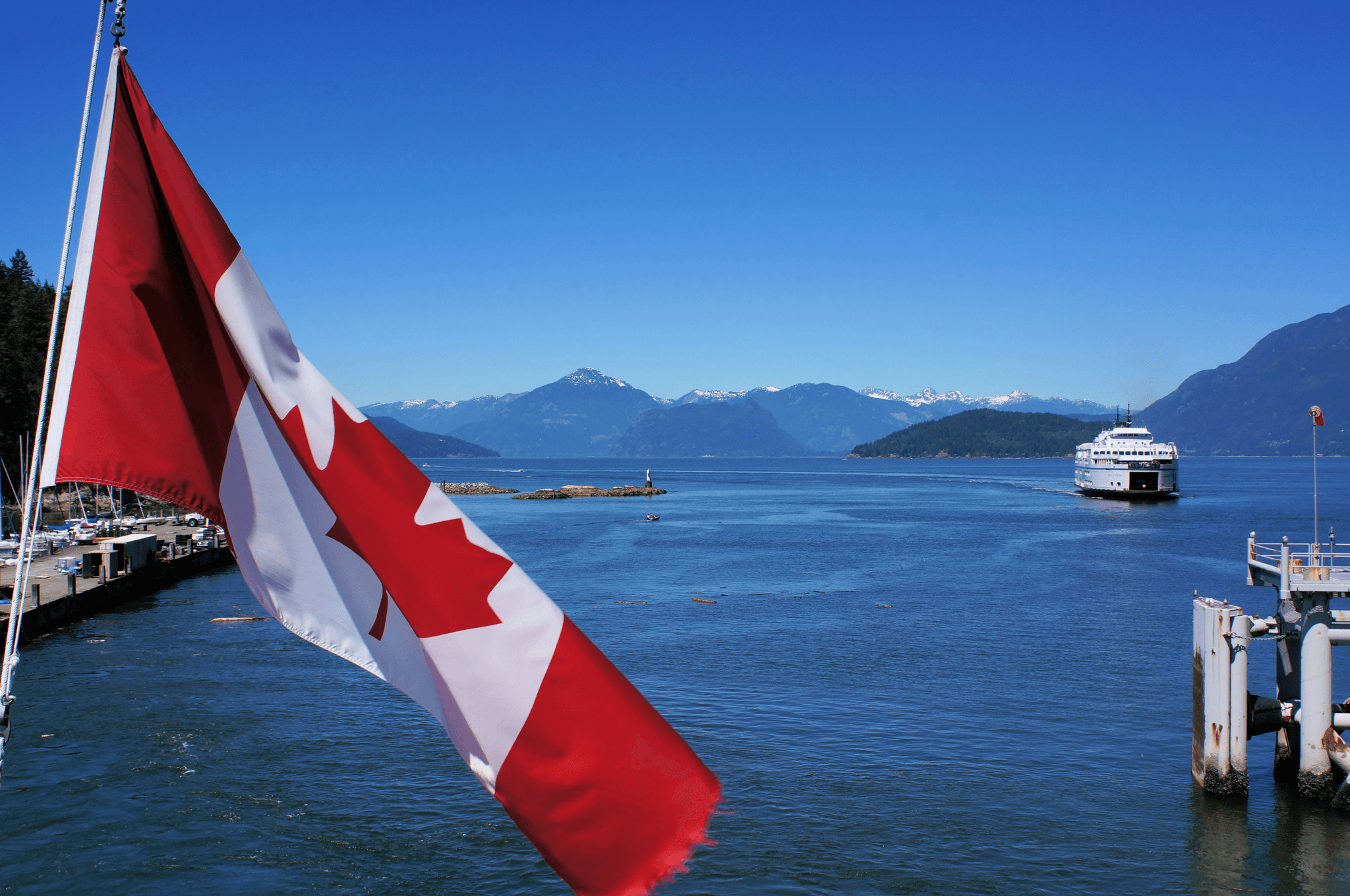

Importing goods from China to Canada can be an exciting venture, but it comes with its fair share of complexities, particularly when it comes to understanding import fees from China to Canada. These fees can significantly impact your overall costs and are crucial for anyone looking to navigate the world of international trade. With the right knowledge and preparation, you can effectively manage these expenses and ensure a smooth importing process.

Understanding Import Fees from China to Canada

When diving into the world of import fees from China to Canada, it's essential to grasp the various components that contribute to these costs. From customs duties and tariffs to shipping charges and taxes, each element plays a vital role in determining how much you’ll pay when your goods arrive at the border. SSOURCING INC. is here to help you decode these fees so that you can make informed decisions for your business.

Navigating Tariffs and Taxes

Navigating tariffs and taxes is another critical aspect of managing import fees from China to Canada. Tariffs are essentially taxes imposed on imported goods, which vary depending on product classifications and origin countries. Understanding how these tariffs work will not only help you budget more accurately but also allow you to strategize around them—potentially saving your business a significant amount in costs.

Importance of Accurate Shipping Documentation

Accurate shipping documentation cannot be overstated when dealing with import fees from China to Canada; it’s your ticket through customs without unnecessary delays or additional charges. Proper documentation ensures compliance with regulations and helps avoid costly mistakes such as misclassification or underreporting value—common pitfalls that many new importers face. At SSOURCING INC., we emphasize meticulous documentation practices as part of our commitment to streamline your importing experience.

A Comprehensive Guide to Import Fees

When diving into the world of importing goods from China to Canada, understanding import fees is crucial. These fees can significantly impact your overall budget and profitability. With a little knowledge and planning, you can navigate these costs effectively and keep your business thriving.

Breakdown of Costs Incurred

Import fees from China to Canada consist of several components that collectively affect your bottom line. First, there are customs duties, which are calculated based on the value of the goods you're bringing in. Additionally, you'll encounter shipping costs, insurance fees, and handling charges — all of which contribute to the total expenses associated with importing.

To make things even more interesting, you might also face additional charges like brokerage fees if you're using a customs broker for assistance with documentation and compliance. It's essential to account for these various costs when planning your import strategy so that you don't end up with any unpleasant surprises down the road. Remember that SSOURCING INC. can help you break down these costs clearly for better budgeting.

Different Types of Import Fees

Understanding the different types of import fees from China to Canada is key to effective financial planning. The primary categories include customs duties, tariffs, and taxes such as the Goods and Services Tax (GST) or Value Added Tax (VAT). Each type has its own calculation methods and implications for your imported goods.

Customs duties are typically based on a percentage of the declared value of your items, while tariffs may vary depending on product classifications under Canada's Customs Tariff schedule. Taxes like GST or VAT apply after calculating other import costs, making it essential to grasp how each fee interacts with one another when importing goods.

Factors Influencing Import Fees

Several factors influence import fees from China to Canada that can either increase or decrease your overall expenses. One significant factor is the classification of goods; different products fall under various tariff codes which determine duty rates accordingly. Accurate classification is vital because misclassification can lead to hefty fines or unexpected charges.

Another factor is the trade agreements in place between countries; for instance, preferential rates may apply under agreements like CETA (Comprehensive Economic Trade Agreement). Furthermore, fluctuations in currency exchange rates can also impact how much you pay in Canadian dollars versus Chinese yuan when calculating total import expenses.

By keeping these factors in mind while working with SSOURCING INC., you'll be better equipped to manage your import fees efficiently and avoid common pitfalls along the way.

Customs Duties and Tariffs Explained

Navigating the world of customs duties and tariffs is essential for anyone looking to import goods from China to Canada. Understanding these fees can significantly impact your overall expenses, making it crucial to grasp their implications. With the right knowledge, you can better predict your import fees from China to Canada and plan accordingly.

What Are Customs Duties?

Customs duties are taxes imposed by governments on imported goods, serving as a way to regulate trade and generate revenue. When you import products from China to Canada, these duties are calculated based on the value of the goods, including shipping costs. It's important to factor in these customs duties when estimating your total import fees from China to Canada, as they can vary widely depending on the product category.

Tariff Classifications for Goods

Every product falls into a specific tariff classification that determines its duty rate upon entry into Canada. This classification system is based on the Harmonized System (HS), which categorizes goods according to their material composition and intended use. Misclassifying your products can lead to unexpected costs or delays in processing, making it vital to accurately identify the correct tariff codes when calculating your import fees from China to Canada.

How Tariffs Affect Your Bottom Line

Tariffs directly influence how much you pay when importing goods, impacting your profit margins significantly. Higher tariffs mean increased import fees from China to Canada, which can make certain products less competitive in pricing compared to local alternatives. By understanding how tariffs work and staying updated with changes in regulations, you can strategize effectively and minimize costs—SSOURCING INC. is here to help you navigate this complex landscape for optimal results.

Value Added Tax (VAT) on Imports

Navigating the world of import fees from China to Canada can be a maze, and one of the key components in this journey is understanding Value Added Tax, or VAT. This tax is levied on goods imported into Canada and is designed to ensure that sales tax is collected at each stage of production and distribution. For businesses looking to import products, grasping how VAT applies is crucial for accurate financial planning.

What is VAT and How It Applies

Value Added Tax (VAT) is a consumption tax assessed on the value added to goods and services at each stage of production or distribution. When importing items from China to Canada, VAT comes into play as soon as your shipment reaches Canadian customs. This means that not only do you need to plan for other import fees from China to Canada, but you must also calculate the applicable VAT based on the total value of your goods.

Understanding how VAT applies helps businesses avoid unexpected costs during the importing process. The rate may vary depending on the product category, which can significantly impact your overall expenses. Therefore, it’s wise to consult with SSOURCING INC., who can provide guidance tailored specifically for your importing needs.

VAT Rates for Different Products

In Canada, the standard VAT rate typically hovers around 13% in provinces like Ontario but can vary by region due to provincial taxes added on top of federal rates. Certain products may have different rates; for example, basic groceries are often exempt while luxury items might carry higher rates. When calculating import fees from China to Canada, knowing these distinctions can help you budget more effectively.

It's essential for importers to familiarize themselves with these varying rates because they directly affect overall costs when bringing products into Canada. SSOURCING INC. offers resources that break down these rates by product category so you can make informed decisions before placing orders with suppliers overseas. This proactive approach ensures you're not caught off guard by unexpected charges upon arrival.

Exemptions and Special Cases

While most imports incur VAT charges, some exemptions exist that could benefit savvy importers looking to minimize their costs when managing import fees from China to Canada. For instance, certain educational materials or medical supplies may be exempt from VAT altogether under specific conditions set by Canadian regulations. Understanding these exemptions allows businesses to take advantage of potential savings while ensuring compliance with local laws.

Additionally, special cases may apply based on trade agreements or specific industry regulations that could further influence your import strategy—another reason why working with experts like SSOURCING INC. proves invaluable in navigating this complex landscape efficiently. By staying informed about exemptions and special cases related to VAT, businesses can optimize their supply chain management while keeping costs manageable.

The Role of SSOURCING INC. in Importing

When it comes to navigating the maze of import fees from China to Canada, having a reliable partner like SSOURCING INC. can make all the difference. We specialize in guiding businesses through the complexities of international trade, ensuring that you understand every aspect of your costs. With our expertise, you can confidently manage your import fees and avoid unexpected surprises.

Expert Guidance on Import Fees

At SSOURCING INC., we pride ourselves on providing expert guidance on import fees from China to Canada, helping you make informed decisions that save time and money. Our team is well-versed in the latest regulations and tariff classifications, ensuring you never miss critical updates that could affect your bottom line. By leveraging our knowledge, you can navigate the intricate world of customs duties and taxes with ease.

Understanding how various factors influence import fees is crucial for successful importing; that's where our expert advice comes into play. We analyze your specific goods and provide tailored recommendations that align with your business needs. With SSOURCING INC.'s support, you'll be equipped to tackle any challenges related to import fees effectively.

Streamlining the Import Process

Streamlining the import process is essential for minimizing delays and keeping costs manageable when dealing with import fees from China to Canada. At SSOURCING INC., we employ best practices to ensure a smooth transition from supplier to destination while maintaining compliance with Canadian regulations. Our efficient systems help eliminate bottlenecks and expedite shipments so you can focus on growing your business.

We also assist in coordinating logistics by connecting you with reliable freight forwarders who understand the nuances of international shipping. This partnership allows us to take care of documentation and customs clearance efficiently, reducing potential headaches along the way. With SSOURCING INC., you'll experience a seamless importing journey that keeps your operations running smoothly.

Additionally, we provide insights into optimizing inventory management strategies based on expected delivery times and costs associated with import fees from China to Canada. By anticipating demand fluctuations, we help ensure you're always stocked without overcommitting resources or facing unnecessary expenses.

Reducing Costs through Effective Planning

Effective planning is key when it comes to reducing costs associated with import fees from China to Canada—and that's where SSOURCING INC.'s expertise shines brightest! We work closely with clients to develop comprehensive strategies that encompass everything from sourcing materials at optimal prices to understanding potential tariff impacts on various products.

By proactively addressing these elements, we empower businesses like yours to make smarter purchasing decisions that ultimately lead to significant savings over time. Our approach includes careful analysis of total landed costs—factoring in shipping expenses, tariffs, and taxes—to give you a complete picture before making commitments.

Moreover, staying ahead of regulatory changes allows us at SSOURCING INC.to adjust plans accordingly so you're never caught off guard by unexpected increases in import fees or new compliance requirements from authorities in Canada or abroad! Partnering with us means you're not just importing goods; you're investing in a streamlined process designed for long-term success.

Common Mistakes to Avoid

Navigating the complexities of import fees from China to Canada can be a daunting task, and many businesses stumble along the way. Understanding the common pitfalls is essential for smooth sailing in your importing journey. Here are a few mistakes to sidestep, ensuring your experience is both efficient and cost-effective.

Misclassification of Goods

One of the most significant blunders importers make is misclassifying goods. Each product falls under specific tariff classifications that dictate the applicable duties and taxes; getting this wrong can lead to unexpected costs or delays. SSOURCING INC. emphasizes the importance of accurately classifying your products to avoid hefty fines or increased import fees from China to Canada.

Proper classification not only affects how much you pay but also impacts compliance with customs regulations. If you're unsure about how to classify a product, seeking expert guidance can save you time and money in the long run. Remember, what seems like a minor detail can have major financial repercussions.

Underestimating Import Fees

Another common mistake is underestimating import fees when budgeting for your shipments. Many businesses fail to account for all potential costs, including customs duties, tariffs, and taxes like VAT; this oversight can lead to cash flow problems down the line. When planning your imports from China to Canada, it's crucial to factor in every conceivable fee associated with bringing goods across borders.

SSOURCING INC.'s expertise can help you create an accurate budget by providing insights into all potential charges involved in importing goods. By having a comprehensive understanding of these costs upfront, you’ll be better prepared for any surprises that may arise during transit or upon arrival at customs. Accurate budgeting not only protects your bottom line but also helps maintain healthy supplier relationships.

Lack of Proper Documentation

Failing to prepare proper documentation is another frequent error that can derail your importing process entirely. Customs authorities require specific paperwork for clearing goods through borders; missing or incomplete documents may lead to delays or additional fees on top of existing import fees from China to Canada. Ensuring all necessary documentation—like invoices, packing lists, and certificates—is in order will streamline your shipping process significantly.

SSOURCING INC.'s team understands what documents are essential for various types of products and can guide you through creating an effective checklist tailored specifically for your needs. Proper documentation not only expedites clearance but also minimizes risks associated with compliance issues that could arise later on. In short, taking care of paperwork upfront saves headaches down the road!

Conclusion

Navigating the world of import fees from China to Canada can be a daunting task, but with the right knowledge and resources, you can turn this challenge into an opportunity. Understanding the intricacies of tariffs, taxes, and shipping documentation is essential for anyone looking to import goods successfully. By keeping abreast of changes in regulations and planning meticulously, you can ensure a smooth importing experience.

Keep Up with Changes in Regulations

Regulations regarding import fees from China to Canada are constantly evolving, which makes it crucial for importers to stay informed. Changes in tariffs or tax rates can significantly impact your overall costs and affect your bottom line if you're not prepared. Regularly checking updates from customs authorities or subscribing to industry newsletters can keep you ahead of the curve.

Plan for the Total Cost of Importing

When importing goods, it's vital to plan not just for the purchase price but also for all associated import fees from China to Canada. This includes customs duties, VAT, shipping costs, and any other potential charges that may arise during transit. A comprehensive understanding of these costs will help you avoid unpleasant surprises and allow for better budgeting.

Partner with Experts for Success

Working with professionals like SSOURCING INC. can make navigating import fees from China to Canada much easier and more efficient. Their expertise in customs regulations and cost management means they can help streamline your importing process while minimizing expenses. By partnering with experts who understand the landscape, you position yourself for success in your importing endeavors.