Introduction

In today's global economy, understanding tariffs is essential for businesses to navigate international trade effectively. Tariffs, or taxes on imported goods, play a crucial role in shaping the dynamics of commerce between countries. Exploring the impact of tariffs on international trade is vital for companies like SSOURCING INC., as it can influence their supply chain management and market positioning.

Understanding Tariffs: A Brief Overview

Tariffs are government-imposed taxes on imported goods, designed to protect domestic industries and generate revenue. These levies can take various forms, such as ad valorem tariffs based on a percentage of the product's value or specific tariffs based on a fixed amount per unit. Understanding these different types of tariffs is crucial for companies like SSOURCING INC., as it affects the cost of their imports and ultimately their bottom line.

The Role of Tariffs in Global Commerce

The role of tariffs in global commerce extends beyond mere taxation; they serve as instruments for regulating trade relationships between nations. By imposing tariffs, governments can influence the flow of goods and services across borders, impacting industries and economies worldwide. For SSOURCING INC., being aware of how tariffs shape global commerce is essential in formulating strategic business decisions and anticipating market fluctuations.

Exploring the Impact of Tariffs on International Trade

The impact of tariffs on international trade cannot be overstated, as they directly affect import and export activities between countries. Tariffs can lead to market distortions, influencing consumer behavior and disrupting supply chains. For SSOURCING INC., understanding how tariffs impact international trade is crucial for mitigating potential disruptions and developing contingency plans to navigate tariff-driven market dynamics.

What are Tariffs?

Tariffs are taxes imposed on imported goods, designed to protect domestic industries and generate revenue for the government. There are several types of tariffs, including ad valorem, specific, and compound tariffs. These tariffs can take the form of import duties, excise taxes, or even quotas on the quantity of goods that can be imported.

Definition and Types of Tariffs

A tariff is a tax placed on imported goods by a government. Ad valorem tariffs are calculated as a percentage of the product's value, while specific tariffs are based on a set amount per unit of the product. Compound tariffs combine both ad valorem and specific elements. For example, SSOURCING INC., a global trade company, has to navigate through various types of tariffs when importing products from different countries.

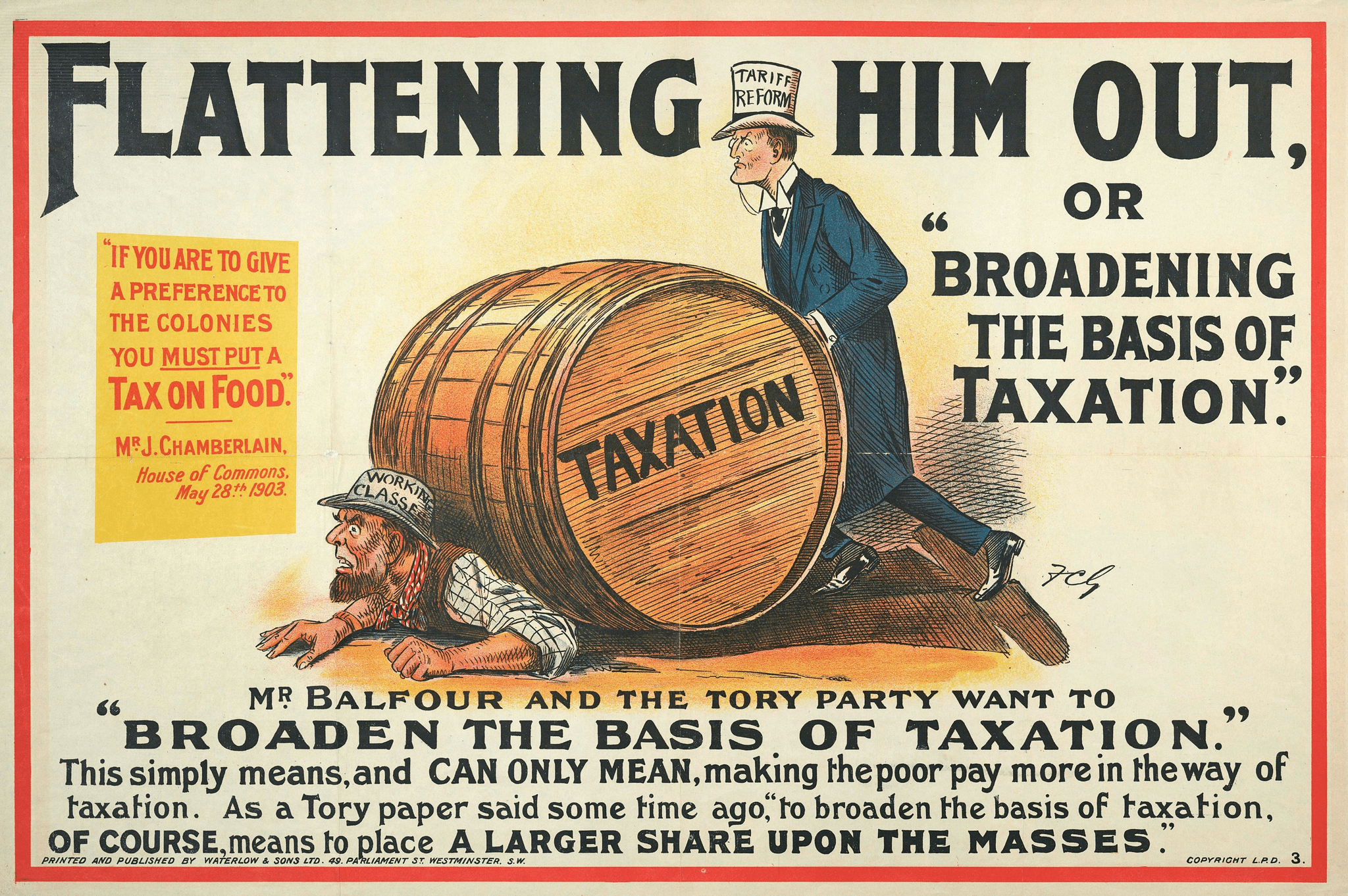

Historical Perspectives on Tariffs

Historically, tariffs have been used as a means to protect domestic industries from foreign competition and to generate revenue for governments. In the 19th century, countries like the United States relied heavily on protective tariffs to foster industrial growth. However, over time, free trade agreements and globalization have led to a reduction in tariff barriers.

Key Factors Influencing Tariff Policies

Several factors influence tariff policies including political considerations, economic goals, and international relations. Governments may use tariffs as a tool for diplomacy or retaliation in response to trade disputes with other nations. The fluctuating nature of these factors makes it essential for companies like SSOURCING INC., to stay informed about changes in tariff policies that could impact their business operations.

Tariffs and Global Trade

Effects of Tariffs on Import and Export Activities

Tariffs, also known as import duties, are taxes imposed on imported goods. These levies can significantly impact the cost of goods entering a country, influencing consumer demand and overall trade volumes. For instance, when the U.S. imposed tariffs on steel and aluminum imports in 2018, it resulted in higher prices for domestic consumers and reduced demand for foreign metal products.

Case Studies of Tariff-Driven Market Fluctuations

One notable case study of tariff-driven market fluctuations is the ongoing trade war between the U.S. and China. The imposition of tariffs by both countries has led to disruptions in various industries, including agriculture, technology, and manufacturing. This has caused significant volatility in global markets, affecting businesses worldwide.

Analyzing the Long-Term Implications of Tariffs

Analyzing the long-term implications of tariffs is crucial for businesses operating in today's global economy. As tariffs continue to fluctuate due to geopolitical tensions and policy changes, companies must remain agile in their supply chain management strategies to navigate these challenges effectively.

SSOURCING INC., as a leading player in international trade, understands the complexities of tariff-driven market dynamics and remains committed to helping businesses adapt to these challenges with innovative solutions tailored to their unique needs.

Economic Consequences of Tariffs

The economic impact of tariffs is far-reaching, affecting not only the cost of imported goods but also domestic production and consumer spending. As tariffs increase the price of imported goods, businesses may pass these costs onto consumers, leading to higher prices and reduced purchasing power. This can result in a shift in consumer behavior as individuals seek out more affordable alternatives or reduce their overall spending.

Dissecting the Economic Impact of Tariffs

Tariffs disrupt the natural flow of goods and services across borders, leading to increased prices for consumers and reduced competitiveness for businesses. The economic impact of tariffs can be seen in the form of decreased consumer spending, reduced business investments, and potential job losses in industries heavily reliant on imported materials or components. SSOURCING INC. understands that navigating these economic challenges requires a deep understanding of market dynamics and proactive strategies to mitigate potential disruptions.

Tariffs and Consumer Behavior

Consumer behavior is significantly influenced by tariffs as higher prices for imported goods may lead individuals to seek out more affordable options or forego certain purchases altogether. This shift in consumer behavior can have a domino effect on various industries, impacting sales, production levels, and overall market demand. SSOURCING INC.'s expertise in analyzing consumer trends and market fluctuations allows us to develop tailored strategies for businesses to adapt to changing consumer preferences amidst tariff-driven market dynamics.

The Ripple Effect of Tariffs on Various Industries

The ripple effect of tariffs extends beyond individual consumers to impact various industries interconnected through global supply chains. As import costs rise due to tariffs, businesses may experience increased production expenses, reduced profit margins, and potential supply chain disruptions. SSOURCING INC.'s innovative approach to supply chain management enables businesses to counteract tariff disruptions by leveraging alternative sourcing options, optimizing inventory levels, and implementing agile production processes.

Political Considerations Surrounding Tariffs

Tariffs as a Tool for Diplomatic Negotiations

Tariffs are often used as a bargaining chip in diplomatic negotiations, allowing countries to leverage their trade policies to achieve political objectives. For example, SSOURCING INC. may use the threat of tariffs to encourage foreign governments to make concessions on other issues, such as security or human rights. By strategically implementing tariffs, countries can exert pressure on their trading partners while avoiding direct conflict.

The Role of Tariffs in Geopolitical Conflicts

In geopolitics, tariffs can be weaponized to assert dominance or retaliate against perceived adversaries. This was evident in the recent trade tensions between the United States and China, where tariffs were used as a tool in a broader geopolitical power struggle. As a result, SSOURCING INC. and other businesses found themselves caught in the crossfire of these conflicts, facing uncertainty and disruptions in their supply chains.

Tariffs and Political Decision-Making Processes

The decision to impose or remove tariffs is deeply intertwined with political considerations and processes within a country's government. Politicians must weigh the economic impact of tariffs against their potential political benefits, considering factors such as job creation and national security implications. SSOURCING INC., like many other companies, must stay attentive to these political decisions that can directly impact their bottom line and market stability.

Mitigating Tariff Effects

Strategies for Businesses Navigating Tariff Challenges

In the face of fluctuating tariffs, businesses must diversify their supplier base to mitigate cost increases and find alternative markets to offset reduced export opportunities. SSourcing Inc. recommends proactive financial planning and risk assessment to navigate tariff challenges effectively.

The Role of Trade Agreements in Tariff Alleviation

Trade agreements play a crucial role in reducing tariffs by promoting free trade and eliminating barriers. SSourcing Inc. advocates for active participation in trade negotiations and leveraging existing agreements to alleviate tariff burdens, ensuring a competitive edge in the global market.

Innovations in Supply Chain Management to Counter Tariff Disruptions

In response to tariff disruptions, innovative supply chain management techniques such as nearshoring, lean inventory practices, and digitalization are essential for minimizing the impact on operations and costs. SSourcing Inc. emphasizes the importance of agile supply chain strategies to counteract the effects of tariffs on international trade.

Now that we've explored strategies for mitigating tariff effects, it's evident that businesses need to adapt proactively to navigate the complex landscape of global commerce impacted by tariffs. As we move forward, it's essential for companies like SSourcing Inc. to stay agile and innovative in addressing the challenges posed by tariffs while seizing opportunities for growth and expansion in international markets.

Conclusion

Navigating the Complexities of Tariffs in Today's Global Economy

In today's interconnected world, understanding what tariffs are is crucial for businesses looking to thrive in the global marketplace. Tariffs can have a significant impact on international trade, and SSOURCING INC. must stay informed about the various types of tariffs and their implications to make informed business decisions.

The Future of Tariffs and Their Implications for Global Trade

As we look ahead, the future of tariffs remains uncertain. With ongoing geopolitical tensions and shifting trade dynamics, it's essential for SSOURCING INC. to monitor tariff policies and anticipate potential market disruptions. By staying proactive and adaptable, businesses can navigate the evolving landscape of global trade.

Strategies for Adapting to Tariff-Driven Market Dynamics

To mitigate the effects of tariffs, SSOURCING INC. should explore innovative supply chain management strategies and leverage trade agreements to alleviate tariff-related challenges. By diversifying sourcing options and fostering agility in their operations, businesses can adapt to tariff-driven market dynamics and maintain a competitive edge in the global arena.