Introduction

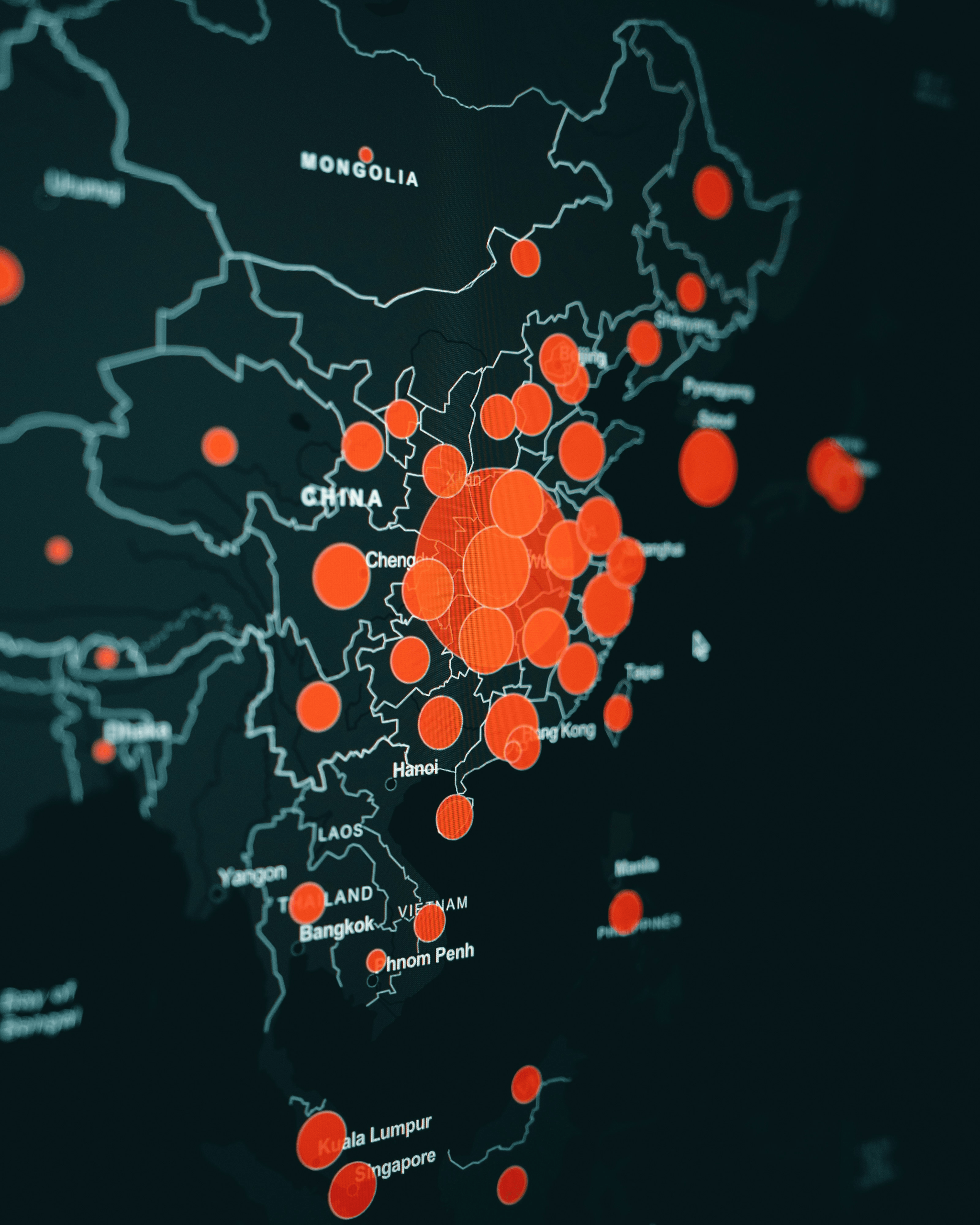

In recent years, the landscape of China import tax has undergone significant transformations, reflecting the country's evolving economic strategies and global trade relationships. These changes are not merely bureaucratic adjustments; they are indicative of a broader shift in how China engages with the world economically. Understanding these shifts is crucial for businesses looking to navigate the complexities of international trade effectively.

Overview of China Import Tax Changes

China's import tax system has seen various reforms aimed at enhancing efficiency and competitiveness in global markets. Recent adjustments have included modifications to tariff rates and the introduction of new compliance measures that affect how goods enter the country. As these changes unfold, businesses must stay informed about how they impact costs and supply chain dynamics, particularly when considering sourcing strategies.

Importance of Global Trade Dynamics

The importance of global trade dynamics cannot be overstated, especially in an interconnected economy where countries rely on one another for goods and services. Changes in China import tax directly influence international supply chains, pricing strategies, and market accessibility for foreign companies. By understanding these dynamics, businesses can better position themselves to capitalize on opportunities while mitigating risks associated with fluctuating tariffs.

SSOURCING INC. and Import Tax Strategies

At SSOURCING INC., we recognize that navigating the intricacies of China import tax is essential for maintaining a competitive edge in today’s market. Our approach involves developing tailored strategies that not only comply with current regulations but also anticipate future changes in tax policies. By leveraging our expertise, we empower our clients to optimize their sourcing processes while minimizing costs associated with import taxes.

Understanding China Import Tax Mechanisms

Navigating the labyrinth of China import tax can feel like deciphering an ancient script, but understanding its mechanisms is crucial for businesses looking to thrive in this dynamic market. The structure of tariffs, the factors influencing these rates, and historical trends all play significant roles in shaping the landscape of international trade with China. For companies like SSOURCING INC., grasping these elements is essential for formulating effective import strategies.

Overview of Tariff Structures

China's tariff structures are not just a set of numbers; they reflect the country's economic policies and strategic priorities. The primary types include Most Favored Nation (MFN) tariffs, which apply to WTO member countries, and preferential tariffs for specific trade agreements. These structures can fluctuate based on political relations and economic conditions, making it imperative for businesses to stay informed about any changes affecting their china import tax obligations.

Tariffs can vary widely by product category, with some items facing higher duties than others based on their perceived value or necessity within China’s economy. Additionally, there are non-tariff barriers such as quotas and licensing requirements that further complicate the import process. For SSOURCING INC., understanding these nuances helps ensure compliance while optimizing costs associated with China import tax.

Factors Influencing Tax Rates

Several factors influence China import tax rates beyond mere product classification; these include domestic production levels, international relations, and global market dynamics. For instance, if China aims to boost local manufacturing in a particular sector, it may impose higher taxes on imports in that category to protect domestic producers. Conversely, during trade negotiations or shifts in diplomatic relations, rates might be adjusted to foster better ties with specific countries.

Economic indicators also play a role; fluctuations in currency exchange rates and inflation can impact how much companies pay when importing goods into China. Moreover, technological advancements may lead to new classifications or exemptions that affect overall taxation strategies for businesses like SSOURCING INC., allowing them to adapt quickly to changing circumstances surrounding China import tax.

Historical Trends in Import Taxation

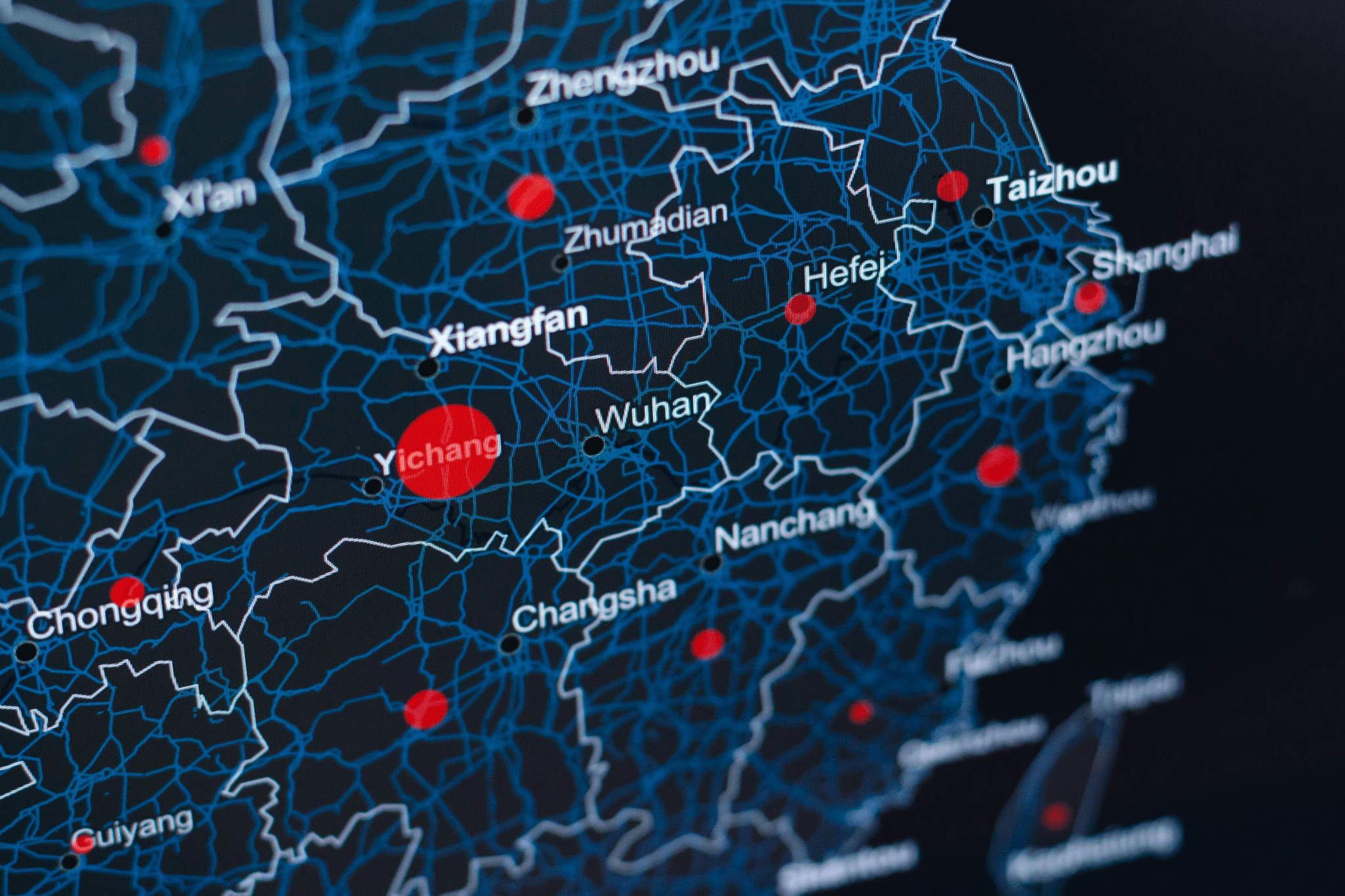

Historically speaking, China import tax has evolved significantly over the decades as China integrated more fully into the global economy. In earlier years, post-WTO accession (2001), tariffs were relatively high but have gradually decreased as part of China's commitment to liberalizing its trade practices. This trend reflects a broader strategy aimed at enhancing competitiveness while attracting foreign investment—a critical aspect for companies looking to enter or expand within this vast market.

Moreover, recent years have seen an increase in targeted tariffs tied to geopolitical tensions and trade wars that have reshaped how businesses approach their supply chains and sourcing strategies. As we look ahead, understanding these historical trends will be vital for anticipating future changes in China import tax policies that could impact operations at firms like SSOURCING INC., especially as they navigate complex international waters.

Trade Agreements and Their Impact

Trade agreements play a pivotal role in shaping the landscape of China import tax, influencing everything from tariff rates to compliance requirements. As businesses navigate this complex environment, understanding these agreements becomes essential for strategic planning and cost management. For companies like SSOURCING INC., being aware of trade dynamics can mean the difference between profit margins and losses.

The Role of Regional Comprehensive Economic Partnership

The Regional Comprehensive Economic Partnership (RCEP) is a game-changer in the realm of international trade, particularly for China import tax. By creating a unified market among member countries, RCEP has streamlined tariffs and reduced trade barriers, making it easier for businesses to operate across borders. This agreement not only enhances trade flows but also allows SSOURCING INC. to leverage lower import taxes when sourcing products from partner nations.

RCEP's impact extends beyond mere numbers; it fosters economic collaboration that can lead to innovation and growth opportunities. With reduced tariffs on various goods, companies can optimize their supply chains while maintaining competitive pricing in the global marketplace. Thus, understanding RCEP is crucial for businesses looking to navigate the intricacies of China import tax effectively.

Effects of Bilateral Trade Deals

Bilateral trade deals also significantly affect China import tax by establishing specific terms that govern trade between the two nations. These agreements often include negotiated tariff reductions or exemptions that can provide substantial savings for businesses engaged in cross-border transactions. For SSOURCING INC., taking advantage of these deals means maximizing profitability while minimizing costs associated with import taxes.

Moreover, bilateral agreements can create a ripple effect on local industries by encouraging foreign investment and fostering competition within domestic markets. As tariffs decrease on imported goods due to these deals, consumers benefit from lower prices and more choices—an outcome that ultimately stimulates economic growth in both countries involved. Therefore, staying informed about current bilateral agreements is essential for any business aiming to thrive amidst changing China import tax regulations.

How Agreements Shape China Import Tax

Trade agreements fundamentally shape the framework within which China import tax operates by dictating tariff structures and compliance standards across various sectors. These regulations are not static; they evolve as countries negotiate new terms or adjust existing ones based on economic conditions or political climates. For SSOURCING INC., adapting strategies according to these changes is vital for maintaining competitiveness in an ever-shifting landscape.

Additionally, as global trends toward protectionism emerge, understanding how these agreements influence China's approach to import taxation becomes increasingly important for businesses looking to enter or expand within this market. Companies must remain agile and prepared to respond swiftly as new tariffs are implemented or existing ones are modified through negotiations or policy shifts—an agility that could very well determine their success amidst evolving china import tax regimes.

In conclusion, navigating the complexities of international trade requires not only awareness but also strategic foresight regarding how various agreements impact China import tax implications for businesses like SSOURCING INC.. By staying informed about RCEP, bilateral deals, and their broader consequences on taxation policies, companies can better position themselves for future growth opportunities while effectively managing costs associated with imports.

Economic Policies and Their Implications

China's economic policies are pivotal in shaping the landscape of global trade, particularly concerning the nuances of China import tax. The government's strategies aim to bolster domestic production while navigating international trade dynamics. As these policies evolve, businesses like SSOURCING INC. must adapt to remain competitive in this shifting environment.

China's Focus on Domestic Production

In recent years, China has intensified its focus on domestic production, aiming to reduce reliance on foreign goods and enhance self-sufficiency. This shift is reflected in the adjustments made to China import tax rates, which can impact the cost structure for imported products. For companies such as SSOURCING INC., understanding these changes is crucial for optimizing sourcing strategies and maintaining profitability.

China's emphasis on local manufacturing not only affects import tax but also encourages innovation within its borders. By incentivizing local enterprises through subsidies and favorable regulations, the Chinese government aims to create a more robust economic ecosystem. Consequently, businesses that rely heavily on imports may find themselves reevaluating their supply chains to align with these national priorities.

The Belt and Road Initiative's Influence

The Belt and Road Initiative (BRI) is a cornerstone of China's strategy for enhancing global trade relations while simultaneously influencing China import tax structures across participating countries. By investing in infrastructure projects worldwide, China seeks to create new markets for its goods while fostering stronger economic ties with partner nations. This initiative can lead to preferential treatment regarding tariffs and taxes for countries involved in BRI projects.

For SSOURCING INC., this presents both opportunities and challenges when navigating international trade routes influenced by BRI developments. Understanding how these infrastructure investments affect trade flows can provide insights into potential reductions in China import tax for certain categories of goods or regions. As the BRI continues to evolve, companies must stay informed about its implications for their sourcing strategies.

Moreover, as more countries align with China's vision through participation in the BRI, we may witness shifts in global supply chains that could further influence China import tax rates over time. Businesses should consider leveraging these partnerships to optimize their logistics operations while remaining agile enough to respond to changing tariff landscapes driven by geopolitical factors.

Government Regulations Affecting Import Tax

Government regulations play a significant role in determining China import tax rates and compliance requirements that businesses must adhere to when trading with China. Recent regulatory changes have focused on streamlining customs processes while imposing stricter compliance measures aimed at protecting domestic industries from unfair competition abroad. For SSOURCING INC., staying abreast of these regulations is essential for effective risk management.

The Chinese government continually revises its policies related to tariffs based on various economic indicators such as inflation rates, currency fluctuations, and international market conditions—factors that directly influence China import tax adjustments over time. Companies engaged in importing goods need robust compliance frameworks that account for these variables while ensuring adherence to local laws governing imports.

Furthermore, understanding how government regulations intersect with broader economic policies will be vital as businesses navigate an increasingly complex landscape shaped by fluctuating trade dynamics and evolving consumer preferences within China’s market sphere. For firms like SSOURCING INC., proactive engagement with regulatory bodies can facilitate smoother operations amid changing rules surrounding China import tax.

Technological Advancements in Trade

In the rapidly evolving landscape of global trade, technological advancements play a pivotal role in shaping how companies navigate complexities like the China import tax. With innovations such as e-commerce platforms, blockchain technology, and cutting-edge supply chain management solutions, businesses are better equipped to optimize their operations and enhance compliance with import regulations. SSOURCING INC. is at the forefront of leveraging these technologies to streamline processes and mitigate challenges associated with import taxation.

E-Commerce and Its Role in Import Tax

E-commerce has revolutionized the way goods are imported and exported, significantly impacting the dynamics of the China import tax landscape. Online marketplaces allow businesses to reach consumers directly, reducing reliance on traditional distribution channels that often involve higher tariffs. By utilizing e-commerce platforms, companies can strategically manage their inventory and pricing structures to minimize exposure to fluctuating import taxes while maximizing market reach.

Moreover, e-commerce enables real-time tracking of shipments, which enhances transparency in customs processes—an essential factor for navigating the complexities of China’s import tax system. This transparency allows businesses to predict costs more accurately and adjust their strategies accordingly. For SSOURCING INC., embracing e-commerce not only means tapping into new revenue streams but also ensuring compliance with evolving regulations surrounding international trade.

Blockchain Technology for Customs Efficiency

Blockchain technology is emerging as a game-changer in improving customs efficiency and addressing issues related to China import tax compliance. By providing a decentralized ledger that records transactions transparently and securely, blockchain can significantly reduce delays at customs checkpoints caused by paperwork discrepancies or fraud attempts. This efficiency is crucial for businesses like SSOURCING INC., where timely clearance can mean the difference between profit margins and losses.

Furthermore, smart contracts—self-executing contracts with terms directly written into code—can automate various aspects of customs procedures, including tariff calculations based on real-time data inputs regarding product classifications and applicable China import tax rates. This automation reduces human error and ensures that all parties adhere strictly to regulatory requirements without unnecessary delays or costs associated with manual processing.

Innovations in Supply Chain Management

Innovations in supply chain management are also reshaping how companies approach challenges related to China import tax obligations. Advanced analytics tools enable businesses to forecast demand more accurately while optimizing inventory levels across multiple locations—key factors that influence overall import costs, including tariffs imposed by Chinese authorities. By streamlining their supply chains, companies can make informed decisions about sourcing materials from different regions based on favorable tariff rates.

Moreover, integrating artificial intelligence into supply chain operations enhances decision-making capabilities by analyzing vast amounts of data related to shipping routes, supplier performance, and regulatory changes affecting China import tax policies. For SSOURCING INC., these innovations not only improve operational efficiency but also empower teams to respond proactively to shifts in trade regulations or market conditions affecting imports into China.

In conclusion, technological advancements such as e-commerce growth, blockchain implementation for customs efficiency, and innovative supply chain management practices are revolutionizing how businesses navigate China import tax challenges today—and tomorrow.

Environmental Regulations and Compliance

In an era where sustainability is becoming a cornerstone of global trade, environmental regulations are increasingly influencing the landscape of China import tax. Governments worldwide, including China, are implementing measures to promote sustainable practices and reduce carbon footprints. This shift not only affects how businesses operate but also reshapes the financial implications of importing goods.

Green Tariffs and Sustainability Initiatives

Green tariffs are designed to encourage environmentally friendly practices by imposing additional taxes on products that fail to meet specific sustainability criteria. In China, these tariffs can significantly impact the overall China import tax burden for companies that do not prioritize eco-friendly sourcing. SSOURCING INC., for instance, is keenly aware of how green tariffs can affect its supply chain decisions, pushing the company towards more sustainable suppliers and practices.

Sustainability initiatives often come with incentives as well; businesses that demonstrate a commitment to green practices may find themselves eligible for reduced rates or exemptions from certain import taxes. This dual approach encourages compliance while fostering a competitive advantage for those who adapt early. The interplay between sustainability initiatives and China import tax creates both challenges and opportunities in navigating international trade.

Impact of Climate Policies on Import Tax

Climate policies play a pivotal role in shaping China import tax structures as countries strive to meet international climate agreements such as the Paris Accord. As China intensifies its focus on reducing greenhouse gas emissions, we can expect an evolution in how import taxes are levied based on environmental impact assessments of imported goods. Companies that rely heavily on imports must stay informed about these changes or risk facing unexpected costs.

The implications extend beyond just financial burdens; they influence sourcing strategies and long-term business planning as well. For instance, if certain materials face higher taxes due to their carbon footprint, SSOURCING INC. might need to pivot towards more sustainable alternatives—an adjustment that could ultimately enhance brand reputation while mitigating risks associated with fluctuating China import tax rates.

SSOURCING INC.'s Approach to Compliance

SSOURCING INC.'s approach to compliance with environmental regulations is proactive rather than reactive; this strategy ensures that we remain ahead of potential changes in China import tax legislation tied to sustainability efforts. By investing in research and development focused on eco-friendly materials and processes, our company positions itself favorably within the evolving regulatory landscape.

Additionally, we maintain close relationships with suppliers who share our commitment to sustainability; this collaboration not only strengthens our supply chain but also minimizes exposure to punitive tariffs associated with non-compliance or environmentally harmful products. By aligning our business model with green initiatives, SSOURCING INC. aims not just for compliance but also seeks out opportunities for growth within the framework of changing China import tax dynamics.

Conclusion

Navigating the ever-evolving landscape of China import tax can feel like trying to solve a Rubik's Cube blindfolded. With the global trade dynamics shifting constantly, businesses must stay vigilant and adaptable. As we look ahead, understanding these changes and their implications will be crucial for maintaining a competitive advantage.

The Future Landscape of Import Tax

The future of China import tax is poised to be influenced by various factors, including economic policies, trade agreements, and technological advancements. As China continues to prioritize domestic production, businesses may see shifts in tariff structures that impact their bottom lines. Moreover, the increasing focus on sustainability could lead to new green tariffs, making compliance more complex yet essential for companies like SSOURCING INC.

Strategies for Businesses Navigating Import Tax

To effectively navigate the complexities of China import tax, businesses should adopt proactive strategies that emphasize flexibility and compliance. This includes staying informed about changes in tariff rates and leveraging data analytics to forecast potential impacts on supply chains. Additionally, forming strategic partnerships with local experts can provide invaluable insights into navigating regulations and optimizing import processes for maximum efficiency.

Preparing for Changes in China Import Tax

Preparation is key when it comes to adapting to changes in China import tax regulations. Companies should conduct regular audits of their supply chains to identify vulnerabilities and areas for improvement while also investing in technology that streamlines customs processes. SSOURCING INC.’s approach emphasizes agility—by remaining informed about policy shifts and engaging with stakeholders early on, businesses can better position themselves for success in this dynamic environment.