Introduction

Navigating the world of import duty can feel like deciphering a complex puzzle, especially when dealing with imports from China to the USA. Understanding the nuances of import duty is crucial for anyone looking to engage in international trade, as it directly impacts costs and pricing strategies. With the right knowledge, you can streamline your importing process and avoid potential pitfalls that could cost you time and money.

Understanding Import Duty Basics

Import duty refers to the taxes imposed by governments on goods brought into a country from abroad, such as those imported from China to the USA. This tax is designed not only to generate revenue for the government but also to protect domestic industries from foreign competition. Grasping these basics is essential for businesses aiming to maintain competitive pricing while adhering to legal requirements.

Why It Matters for Imports

The significance of import duty cannot be overstated; it directly affects your bottom line when importing goods from China to the USA. A higher duty rate can substantially increase the cost of your products, potentially making them less competitive in the market. Therefore, understanding how these duties work will help you make informed decisions that align with your business goals.

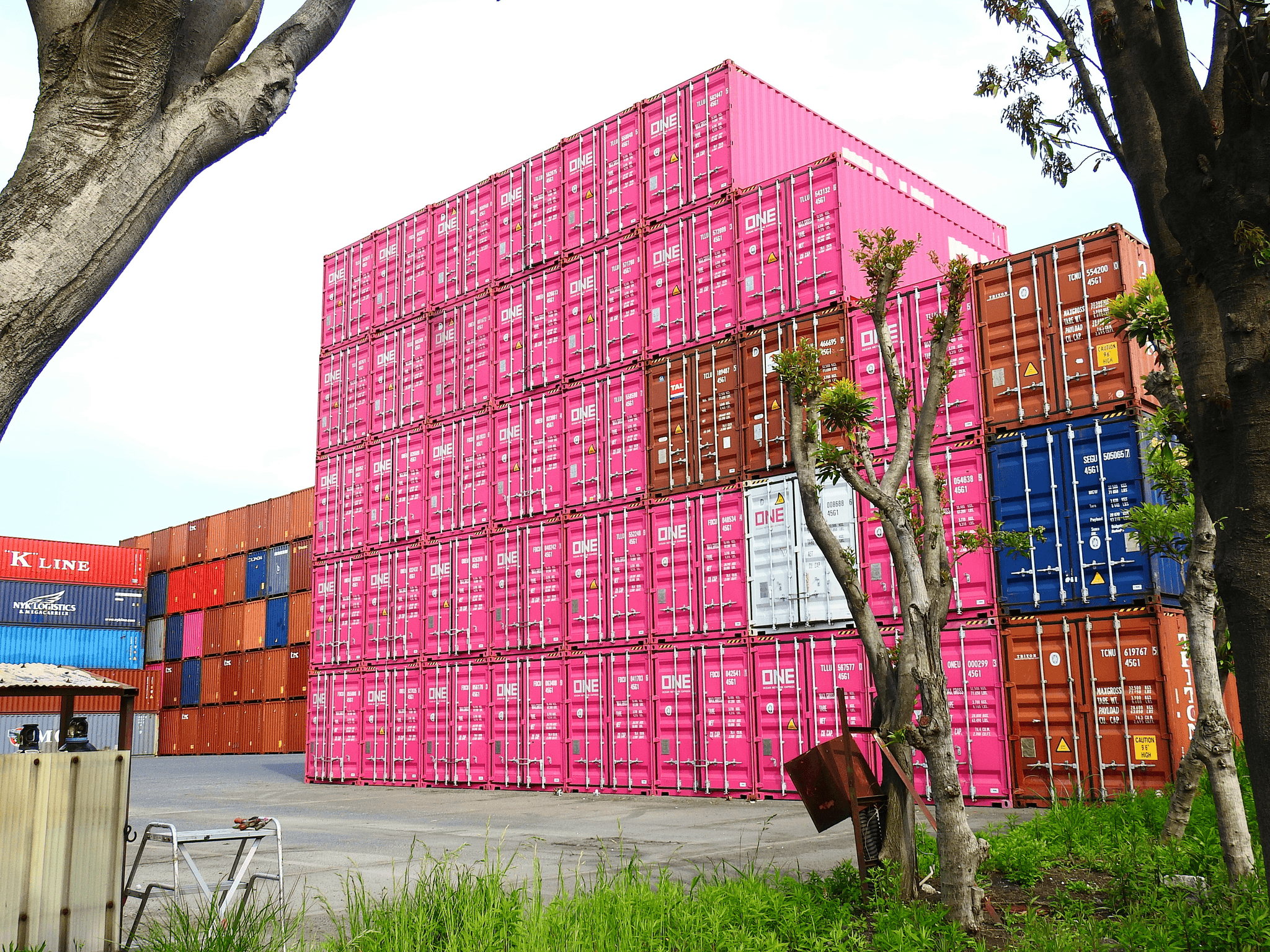

Quick Overview of the Process

The process of dealing with import duty involves several key steps: determining applicable rates, preparing necessary documentation, and ensuring compliance with customs regulations. First, you'll need to assess how much import duty applies to your specific products imported from China to the USA by consulting resources like the Harmonized Tariff Schedule. Next, accurate documentation will be vital in facilitating smooth customs clearance—this is where SSOURCING INC. comes into play, offering expertise and support throughout this intricate journey.

What is Import Duty?

Import duty is a tax imposed by a government on goods brought into the country. This duty is designed to protect domestic industries, regulate trade, and generate revenue for the government. Understanding import duty from China to the USA is essential for anyone involved in international trade or e-commerce.

Definition and Purpose

At its core, import duty refers to the tariffs charged on products entering a country, which can vary significantly based on the type of goods and their origin. The primary purpose of these taxes is to encourage local production while discouraging excessive foreign imports that could harm local businesses. For those importing from China to the USA, knowing the specific duties applicable can help in budgeting and pricing strategies.

How It Affects Pricing

Import duty plays a significant role in determining retail prices for imported goods. When calculating costs for products coming from China to the USA, businesses must factor in these additional expenses as they can dramatically affect profit margins. As such, understanding how import duty impacts pricing allows companies like SSOURCING INC. to make informed decisions about sourcing and selling products.

Key Terms You Should Know

When navigating the world of import duties, certain terms are crucial for clarity and compliance. Terms like tariff classification, ad valorem, and specific duty frequently come up in discussions about import duty from China to the USA; each has its own implications for cost calculations. Familiarizing yourself with these terms not only aids in smoother transactions but also empowers you to communicate effectively with customs brokers or suppliers.

Determining the Duty Rate

Navigating the complexities of import duty from China to the USA can feel like deciphering a secret code, but fear not! Understanding how duty rates are determined is crucial for any importer looking to keep costs under control. Let’s break down the key elements that influence these rates, ensuring you can plan your imports with confidence.

Factors Influencing Duty Rates

Several factors come into play when determining the import duty from China to the USA. The type of product being imported is paramount; different categories have varying duty rates based on classification and use. Additionally, country of origin matters—products sourced from certain countries may enjoy reduced or eliminated duties due to trade agreements or tariffs.

Another critical factor is the transaction value of your goods, which includes shipping costs and insurance. Higher values typically mean higher duties, so it’s essential to accurately declare these amounts on your customs documentation. Lastly, any special regulations or quotas in place could further affect your import duty rates, making it vital to stay informed about current trade policies.

The Harmonized Tariff Schedule

The Harmonized Tariff Schedule (HTS) is your best friend when it comes to navigating import duties from China to the USA. This comprehensive system categorizes all possible goods entering the country and assigns them specific codes that dictate their corresponding duty rates. By understanding how to read this schedule, you can easily identify what you'll owe for each item you import.

When using the HTS, remember that classification accuracy is key; misclassifying an item can lead to unexpected fees or delays at customs. If you're unsure about proper classification, consulting with professionals at SSOURCING INC. can save you time and money by ensuring everything is correctly categorized from the start.

Tools to Calculate Your Duty

Calculating your import duty from China to the USA doesn’t have to be a headache; there are plenty of tools available designed specifically for this purpose! Online calculators allow you to input product details and quickly estimate potential duties based on current HTS codes and applicable tariffs. These tools often consider factors such as shipping costs and insurance for a more accurate assessment.

For those who prefer a more hands-on approach, many freight forwarders or customs brokers offer personalized calculations as part of their services—just another reason why partnering with a reputable company like SSOURCING INC. can make all the difference in streamlining your importing process! Armed with accurate calculations in advance, you’ll be better prepared for any financial implications before placing orders.

Essential Documentation

When it comes to navigating the complexities of import duty from China to the USA, having the right documentation is crucial. Proper paperwork not only ensures compliance but also speeds up the customs clearance process, allowing your goods to reach you without unnecessary delays. In this section, we’ll explore three essential components: Customs Declaration Forms, accurate invoicing, and required certificates and permits.

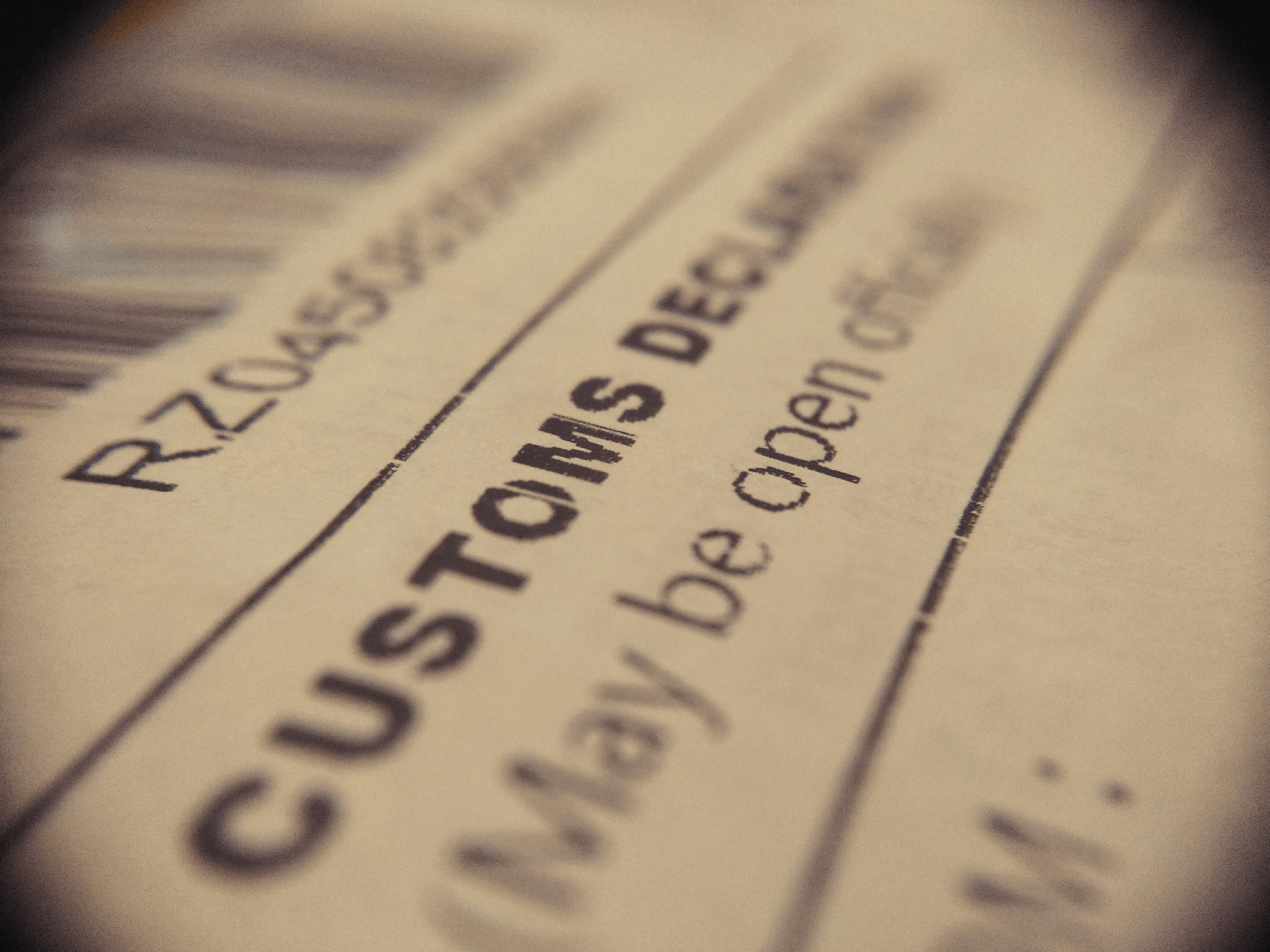

Customs Declaration Forms

Customs Declaration Forms are the backbone of your import process when dealing with import duty from China to the USA. These forms provide customs officials with detailed information about your shipment, including its value, quantity, and nature. Failing to fill out these forms accurately can lead to delays or even fines—so make sure you have them completed correctly before your goods arrive.

The most commonly used form is CBP Form 7501, which serves as an entry summary for imported merchandise. This document must be submitted along with supporting documentation that substantiates the information provided in the declaration form. Remember that SSOURCING INC. can assist you in ensuring that all necessary forms are filled out properly to facilitate a smooth customs experience.

Importance of Accurate Invoicing

Accurate invoicing plays a pivotal role in determining your import duty from China to the USA and affects how much you'll ultimately pay upon entering U.S. territory. An invoice needs to reflect not just the price of goods but also any additional costs such as shipping and insurance that may influence duty calculations. If discrepancies arise between your invoice and what customs expects, it could lead to costly delays or penalties.

Moreover, an accurate invoice simplifies verification processes by customs officials and helps avoid misunderstandings regarding declared values versus actual transaction prices. This is where SSOURCING INC.’s expertise comes into play; we ensure that all invoices meet regulatory requirements while being clear and concise for ease of processing at customs.

Required Certificates and Permits

Certain products may require specific certificates or permits when importing goods into the USA; this is especially crucial for items subject to import duty from China to the USA like agricultural products or electronics. For instance, food items often need FDA approval certificates while certain textiles might require a quota visa or other trade compliance documents before they can clear customs smoothly.

Failing to present these required documents could result in significant delays at ports of entry or even confiscation of goods—definitely not ideal! That’s why partnering with experts like SSOURCING INC., who understand these requirements inside out, can save you time and frustration during your importing journey.

Special Cases and Exemptions

When dealing with import duty from China to the USA, it's essential to be aware of special cases and exemptions that can impact your costs and processes. Understanding these nuances can save you money and time, allowing for smoother transactions when importing goods. Let’s dive into some of the key areas where exemptions may apply.

Understanding Tariff Exemptions

Tariff exemptions are like a golden ticket for importers; they allow certain goods to enter the country without incurring import duty from China to the USA. These exemptions can be based on various factors, including the type of goods, their intended use, or even specific trade agreements between countries. It’s crucial to research whether your products qualify for any exemptions before shipping, as this could significantly reduce your overall costs.

Many businesses overlook tariff exemptions simply because they aren’t aware of them or don’t know how to apply for them properly. If you’re importing items that fall under specific categories—like educational materials or certain machinery—there's a good chance you might be eligible for these benefits. SSOURCING INC. can help you navigate these waters by providing insights into which goods may qualify and how to secure those exemptions effectively.

Special Duty Programs

In addition to standard tariff exemptions, there are also special duty programs designed to facilitate trade under specific conditions. For example, programs like the Generalized System of Preferences (GSP) allow certain products from developing countries—including China—to enter the U.S. with reduced or eliminated duties. This is particularly beneficial if you're looking at importing lower-cost items that still meet quality standards.

It’s worth noting that eligibility for these programs often requires thorough documentation and compliance with regulations set forth by customs authorities. If you're unsure whether your imports qualify under such special duty programs, consulting with experts at SSOURCING INC. can provide clarity and guidance tailored specifically for your needs in navigating import duty from China to the USA.

Differences for Non-Commercial Shipments

When it comes to non-commercial shipments—think gifts or personal items—the rules surrounding import duty from China to the USA change quite a bit compared to commercial imports. Generally speaking, non-commercial shipments may have higher exemption limits before duties kick in, which can be a significant advantage if you're sending personal packages rather than bulk merchandise for resale.

However, don’t let your guard down! Even non-commercial shipments require accurate documentation and adherence to customs regulations; otherwise, you could face delays or unexpected charges upon arrival in the U.S. At SSOURCING INC., we understand these differences well and are here to help ensure that your non-commercial imports go through smoothly without unnecessary complications related to import duties.

Tips for Smooth Customs Clearance

Navigating the maze of customs clearance can feel like trying to find your way out of a hedge maze blindfolded. With the right strategies in place, however, you can make the process smoother and less stressful. Here are some essential tips to ensure that your imports, especially when dealing with import duty from China to USA, sail through customs without a hitch.

Choosing the Right Customs Broker

Selecting an experienced customs broker is like having a seasoned tour guide on your journey through the complex world of import duty from China to USA. A knowledgeable broker understands the nuances of tariffs, regulations, and documentation required for smooth clearance. They can help you navigate potential pitfalls and ensure that all paperwork is in order—saving you time and money in the long run.

When looking for a customs broker, consider their track record with similar shipments and their familiarity with products similar to yours. Ask for recommendations or read reviews to ensure you’re working with someone who knows their stuff. Remember, having a reliable customs broker can make all the difference when it comes to managing your import duty costs effectively.

Importance of Compliance

Compliance is not just a buzzword; it’s crucial when dealing with import duties from China to USA. Ensuring that all your documents are accurate and complete will help you avoid delays at customs and unexpected fines that could eat into your profits. Regulatory bodies take compliance seriously; any discrepancies could lead to additional scrutiny or even seizure of goods.

Staying compliant also means keeping up-to-date with any changes in trade regulations or tariffs that may affect your shipments. Regular training for staff involved in importing processes can be beneficial as well—knowledge is power! By prioritizing compliance, you're not just following rules; you're setting yourself up for smoother transactions and better relationships with suppliers.

Common Pitfalls to Avoid

Importing goods comes with its fair share of challenges, but there are some common pitfalls that many fall into when dealing with import duty from China to USA—don't be one of them! One major mistake is underestimating the importance of accurate invoicing; incorrect values can lead to higher duties or even penalties from customs authorities.

Another pitfall is neglecting proper documentation; missing paperwork can delay clearance significantly while costing you extra fees along the way. Always double-check that you have everything needed before shipping—better safe than sorry! Finally, don't overlook tariff classifications; misclassifying goods may trigger audits or additional charges down the line.

In summary, being proactive about choosing a reliable customs broker, ensuring compliance at every step, and avoiding common mistakes will set you on course for successful importing through SSOURCING INC., making those pesky import duties less daunting along the way!

Conclusion

Navigating the world of import duty from China to the USA can feel like solving a complex puzzle, but it doesn’t have to be overwhelming. Understanding how import duty works is crucial for anyone looking to bring goods into the United States, as it directly impacts your overall costs and pricing strategies. With the right knowledge and tools, you can streamline your importing process and avoid unnecessary headaches.

Key Takeaways on Import Duty

Import duty from China to the USA is essentially a tax imposed on goods entering the country, designed to protect domestic industries while generating revenue for the government. Knowing how these duties are calculated helps you factor them into your budget when planning shipments. Additionally, being aware of key terms related to import duties can empower you in discussions with customs brokers and suppliers.

Navigating the Process with Ease

The process of navigating import duty can be simplified by leveraging resources like the Harmonized Tariff Schedule and online calculators that help determine applicable rates. Staying organized with essential documentation—such as customs declarations and invoices—ensures smoother customs clearance, reducing delays at ports of entry. With a little preparation and understanding, you can turn what might seem like a daunting task into a manageable routine.

How SSOURCING INC. Can Help You

At SSOURCING INC., we specialize in guiding businesses through the intricacies of importing goods from China to the USA, including navigating import duty regulations effectively. Our experienced team provides tailored solutions that simplify compliance while maximizing efficiency in your supply chain operations. Whether you're new to importing or looking to optimize your current processes, we're here to support you every step of the way.