Introduction

Navigating the complex world of China customs clearance procedure can be a daunting task for importers. Understanding China customs regulations is crucial to ensuring a smooth and efficient clearance process. At SSOURCING INC., we recognize the importance of working with key players in China customs clearance to streamline operations and avoid unnecessary delays.

Understanding China Customs Regulations

It's essential to have a solid grasp of China's customs regulations to avoid potential pitfalls and ensure compliance with import requirements. Our team at SSOURCING INC. can provide valuable insights into the nuances of these regulations, helping you navigate the process with confidence.

Key Players in China Customs Clearance

From customs brokers to freight forwarders, there are several key players involved in the China customs clearance process. Partnering with reputable experts like SSOURCING INC. can provide invaluable support and guidance throughout the entire clearance journey.

Navigating the Chinese Customs Process

The Chinese customs process can be intricate and time-consuming, but with the right approach, it can be managed effectively. At SSOURCING INC., we understand the intricacies of navigating the Chinese customs process and can help you develop a strategic plan for seamless import operations.

Preparing Your Documentation

When navigating the complex China customs clearance procedure, it's crucial to have all the necessary paperwork in order. This includes the commercial invoice, packing list, and bill of lading or airway bill. These documents are essential for customs officials to verify the contents of your shipment and ensure compliance with import regulations.

Required Paperwork for China Customs Clearance

To successfully clear your goods through Chinese customs, you'll need to prepare several key documents. These include a commercial invoice detailing the value of your goods, a packing list specifying the contents of each package, and a bill of lading or airway bill serving as proof of shipment. These documents are vital for customs officials to assess duties and taxes accurately.

Tips for Organizing Your Customs Documents

Organizing your customs documents is essential for a smooth clearance process. Make sure to keep all paperwork neatly organized and easily accessible. Label each document clearly and maintain digital copies as backups in case physical copies are lost during transit or inspection. Working with an experienced customs broker like SSOURCING INC. can also help streamline this process.

Working with Top Customs Brokerage Firms

Partnering with top customs brokerage firms like SSOURCING INC. can significantly ease the burden of preparing your documentation for China customs clearance. These experts have in-depth knowledge of Chinese import regulations and can guide you through the paperwork requirements efficiently. By leveraging their expertise, you can ensure that all necessary documentation is in order before your shipment reaches Chinese ports.

Understanding Import Duties and Taxes

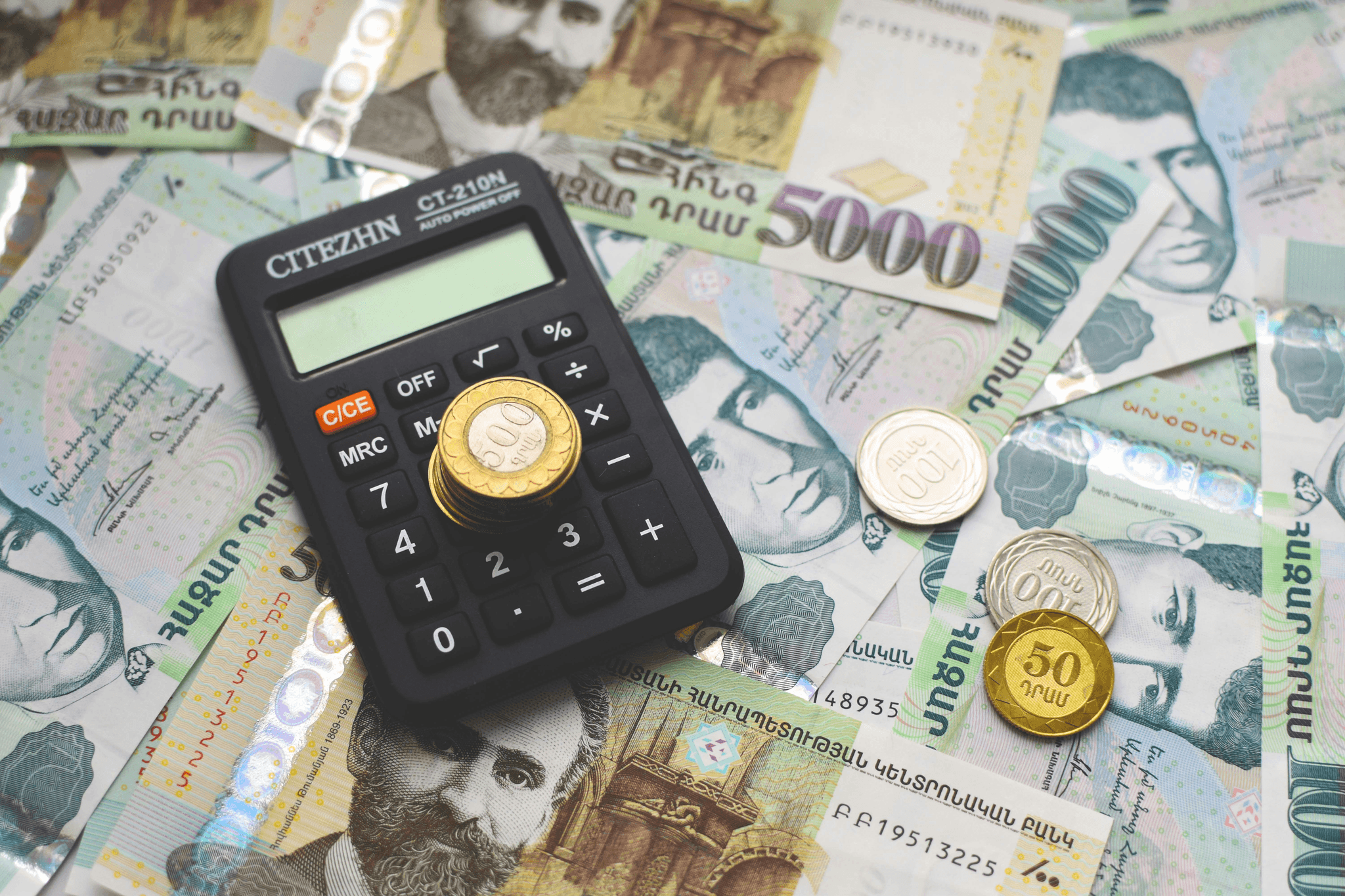

Exploring China's Import Duty Structure

When navigating the China customs clearance procedure, it's crucial to understand the import duty structure. Import duties in China are calculated based on the customs value of goods, which includes the cost of the goods, insurance, and freight. These duties can vary depending on the type of goods being imported and are an essential consideration for importers looking to bring products into China. Understanding these duties is key to planning a successful customs clearance process with SSOURCING INC.

Managing VAT and Other Taxes

In addition to import duties, managing Value Added Tax (VAT) and other taxes is a critical aspect of the China customs clearance procedure. VAT in China is levied on imported goods at varying rates depending on the type of product. It's essential for importers to factor in these taxes when planning their import operations with SSOURCING INC., as they can significantly impact the overall cost of importing goods into China.

Utilizing Duty Reduction Programs

To optimize your customs clearance process with SSOURCING INC., it's important to explore duty reduction programs available in China. Certain goods may be eligible for preferential duty rates or exemptions under specific trade agreements or programs. By leveraging these programs, importers can minimize their duty obligations and enhance their competitiveness in the Chinese market.

Navigating Customs Inspections

Navigating customs inspections is a crucial step in the China customs clearance procedure. It's essential to prepare your documentation meticulously to minimize the risk of delays or rejections. Working with a reputable customs brokerage firm like SSOURCING INC. can provide invaluable guidance and support throughout the inspection process.

Tips for Smooth Customs Inspections

To ensure smooth customs inspections, it's vital to have all your paperwork in order and readily accessible. Label your documents clearly and organize them according to the requirements of Chinese customs authorities. Additionally, communicate openly with your customs broker at SSOURCING INC., as they can offer valuable advice on how to navigate potential inspection challenges.

Understanding Risk Management in Customs Clearance

Understanding risk management in customs clearance involves identifying potential areas of concern and taking proactive steps to mitigate them. By partnering with SSOURCING INC., you can leverage their expertise in risk assessment and develop strategies to minimize the likelihood of inspection issues.

Avoiding Common Inspection Pitfalls

Common inspection pitfalls include incomplete or inaccurate documentation, which can lead to delays and additional costs. By working closely with SSOURCING INC., you can gain insights into common pitfalls and learn how to avoid them, ensuring a smoother customs clearance process for your imports.

Utilizing Technology for Clearance Efficiency

In today's fast-paced business environment, staying on top of the ever-changing China customs clearance procedure is crucial for importers. One way to streamline this process is by adopting automated customs clearance systems. These systems can help SSOURCING INC. to efficiently manage and track all documentation, reducing the risk of errors and delays in customs clearance.

Adopting Automated Customs Clearance Systems

Automated customs clearance systems can significantly improve efficiency by automating routine tasks such as document processing and data entry. By integrating these systems into your import operations, SSOURCING INC. can ensure that all required paperwork is accurately filed and readily accessible, saving time and reducing the likelihood of compliance issues.

Working with Online Customs Clearance Platforms

Online customs clearance platforms offer a convenient way to manage the entire customs clearance process from one centralized location. These platforms provide real-time updates on shipment status, facilitate communication with customs officials, and enable quick responses to any issues that may arise during the clearance process.

Leveraging AI in Customs Processing

Artificial intelligence (AI) technology has revolutionized various industries, including customs processing. By leveraging AI-powered solutions for data analysis and risk assessment, SSOURCING INC. can enhance accuracy in classification and valuation of goods, ultimately ensuring smoother customs clearance procedures.

By embracing technological advancements in customs processing, SSOURCING INC. can optimize its import operations while maintaining compliance with China's intricate customs regulations.

Post-Clearance Compliance

Now that your goods have successfully cleared China customs, it's crucial to ensure ongoing compliance with regulations to avoid any potential issues. SSourcing Inc. understands the importance of post-clearance compliance and can help you navigate this process seamlessly.

Ensuring Compliance with China Customs Regulations

To maintain compliance with China customs regulations, it's essential to stay updated on any changes or updates to the laws. SSourcing Inc. can provide you with expert guidance on how to ensure that your import operations align with the latest requirements, helping you avoid any penalties or delays in the future.

Handling Post-Clearance Audits and Investigations

In the event of a post-clearance audit or investigation by Chinese customs authorities, it's crucial to have all your documentation and records in order. SSourcing Inc. can assist you in preparing for such scenarios, ensuring that you have all the necessary information readily available to address any inquiries from customs officials.

Developing a Compliance Strategy for Future Shipments

Looking ahead, it's important to develop a comprehensive compliance strategy for all your future shipments into China. With SSourcing Inc.'s expertise in customs clearance procedures, we can help you establish best practices and protocols to ensure ongoing adherence to regulations and smooth clearance processes for all your imports.

By partnering with SSourcing Inc., you can rest assured that your post-clearance compliance needs are well taken care of, allowing you to focus on growing your business without worrying about potential customs issues down the line.

Conclusion

Navigating the complex China customs clearance procedure can be a daunting task, but with the right knowledge and support, it can be simplified and streamlined. By partnering with industry-leading customs clearance experts like SSOURCING INC., you can ensure a smooth and efficient process for your import operations.

Simplifying Your China Customs Clearance Process

Simplifying your China customs clearance process is crucial for avoiding delays and ensuring compliance. With the help of SSOURCING INC., you can streamline your documentation, understand import duties and taxes, navigate customs inspections, utilize technology for efficiency, and ensure post-clearance compliance.

Partnering with Industry-Leading Customs Clearance Experts

Partnering with industry-leading customs clearance experts like SSOURCING INC. can make all the difference in your import operations. Their expertise in navigating China's customs regulations, their strong relationships with key players in the process, and their commitment to maximizing efficiency will give you peace of mind as you import goods into China.

Maximizing Efficiency in Your Import Operations

Maximizing efficiency in your import operations is essential for staying competitive in today's global market. By working with SSOURCING INC., you can leverage their knowledge of the latest technologies, their understanding of risk management in customs clearance, and their strategic approach to post-clearance compliance to ensure that your import operations run smoothly and seamlessly.